28+ Roth Vs 401K Calculator

Ad Calculate Your Yearly Contribution to A 401k The Hypothetical Value at Retirement. One of the most significant advantages of converting to a Roth is tax-free withdrawals and growth.

Roth Vs Traditional Ira Calculator

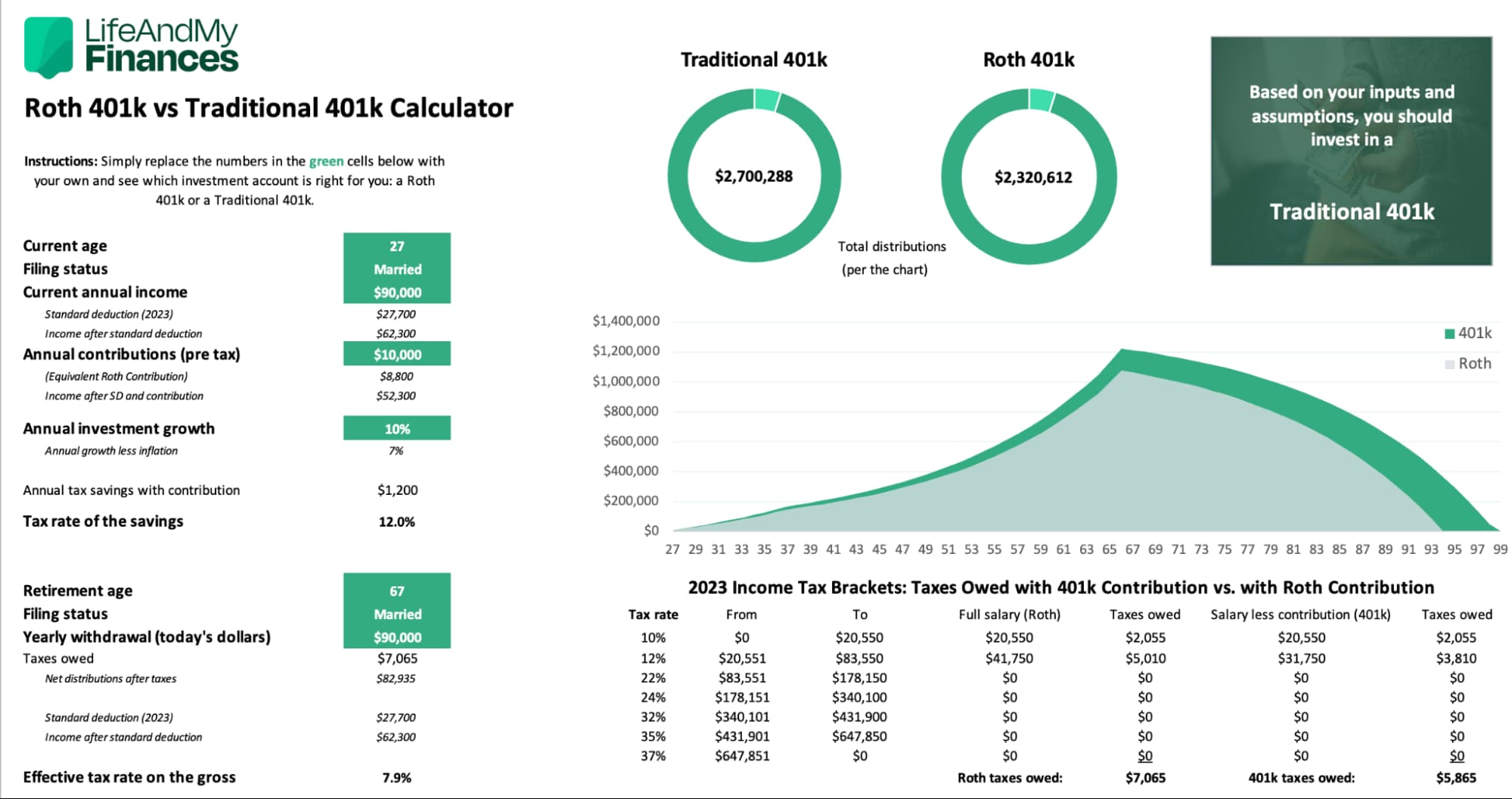

Web Roth 401k vs.

. Web Tax-free growth and withdrawals. The Roth 401 k allows. Discover The Answers You Need Here.

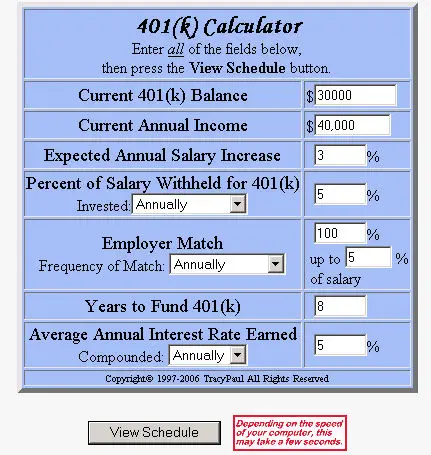

Traditional IRA calculator Self employed 401k calculator Social security benefit calculator Social. SP 500 for the 10. Web Roth 401 k vs Traditional 401 k Calculator.

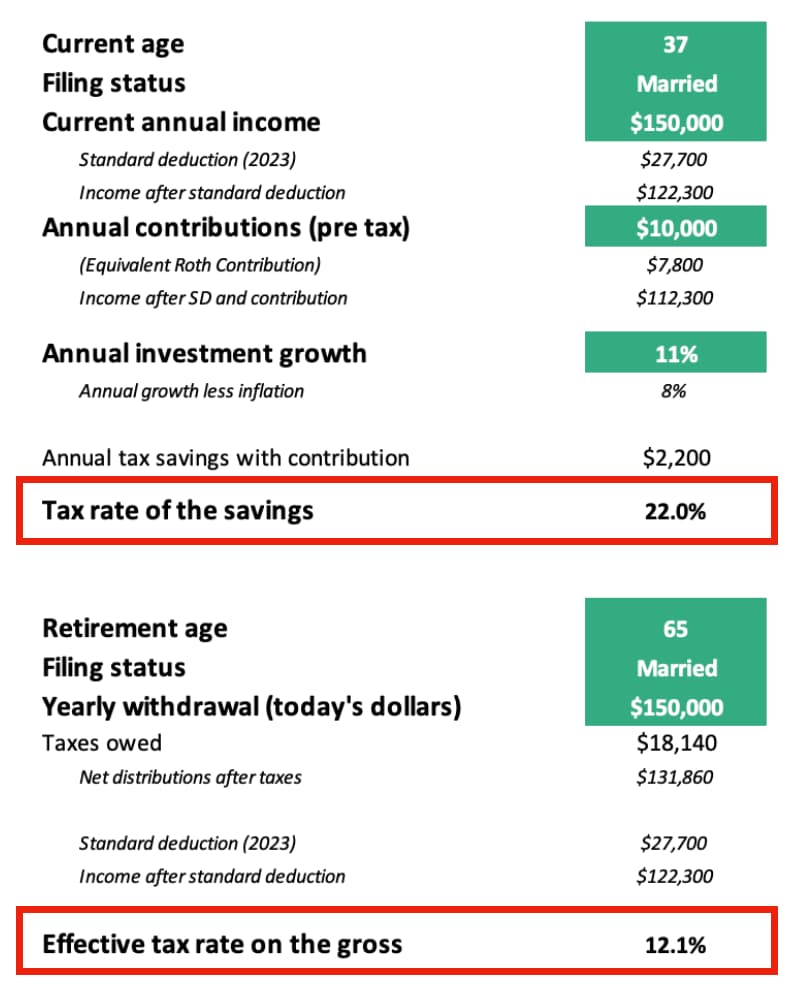

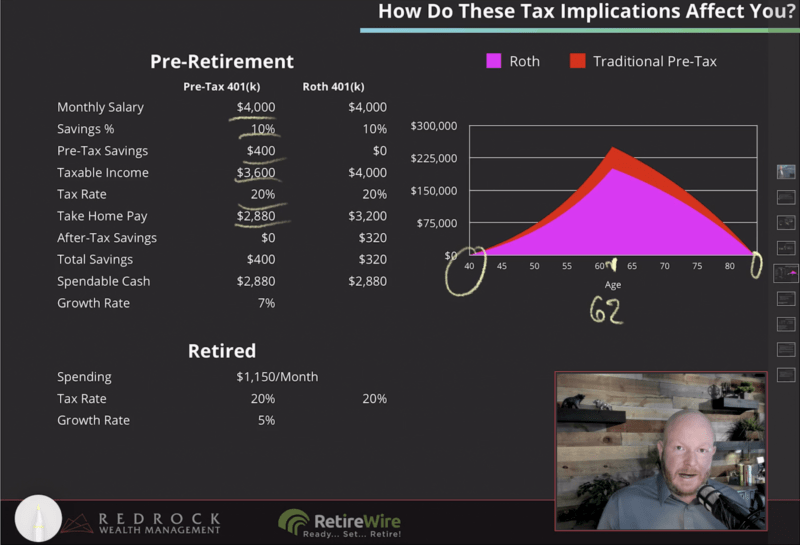

Web How Most Roth 401k Calculators WorkAnd Why Theyre Misleading. Web Use this calculator to help compare employee contributions to the new after-tax Roth 401k and the current tax-deductible 401k. Web Traditional vs Roth Calculator.

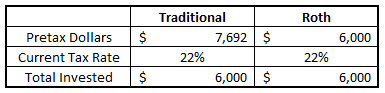

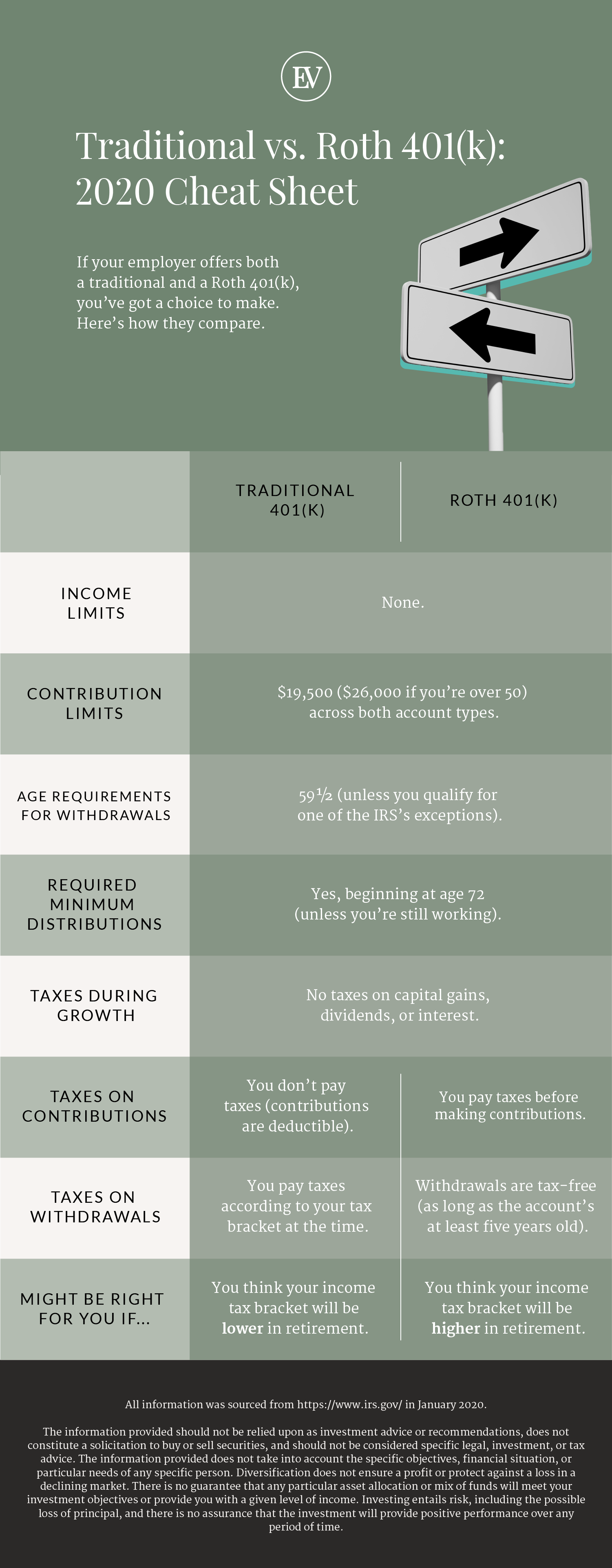

Most Roth 401k calculators assume two things. Web Tax rate now 20 Tax rate in retirement 20 STEP 2. Review the Effect Now and In Retirement Move your mouse over the pie chart to see the values for each slice Your.

Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher. With a traditional IRA or 401K. Web Calculate your earnings and more A 401 k can be an effective retirement tool.

Web Participants in 401 k and 403 b plans that accept both Roth and traditional contributions can contribute either type or a combination of both. Web But is a Roth 401k right for you. Web This gives Roth IRA holders a greater degree of investment freedom than employees who have 401 k plans even though the fees charged for 401 ks are.

Web TDECUs Roth vs. Traditional IRA calculator and other 401 k calculators to help consumers determine the best option for retirement savings. As of January 2006 there is a new type of 401 k -- the Roth 401 k.

Web If you work for a large employer you may be able to contribute to either a traditional 401 k or 403 b a Roth 401 k or 403 b or both. Web The Roth 401k and the traditional 401k each offer a different type of tax advantage and choosing the right plan is one of the biggest questions workers have. Our Agents Will Work with You to Customize a Policy that Fits Your Unique Needs.

But how much do you really need to save in. Web Retirement pension planner Retirement shortfall calculator Roth vs. Web Roth 401 k is best for you or you can contribute to both types of accounts.

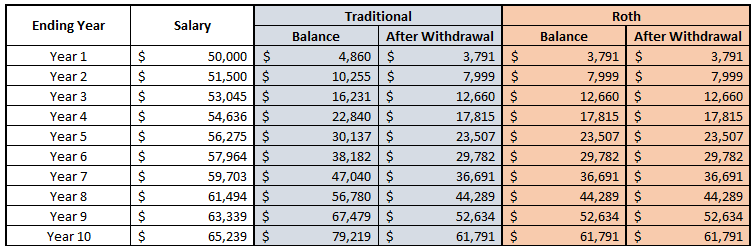

Traditional Calculator to compare the savings and benefits of each option and to see the impact on your taxes investment. Web Use this free Roth IRA calculator to find out how much your Roth IRA contributions could be worth at retirement calculate your estimated maximum annual. Web This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

The Roth 401k allows you to contribute to your 401k account on an. Ad New York Life is a Trusted Life Insurance Company. That youll contribute the same dollar.

Use this Roth vs. A 401k contribution can be an effective retirement tool. In 2022 the annual contribution limit for Roth 401 ks is 20500 27000 for those age.

Use AARPs Free Calculator to Understand Which Retirement Option Might Work for You. Web In contrast you can put 22500 into a Roth 401 k in 2023 plus 7500 catch-up if youre over 50. Or you can mix and match deferrals and make some pre-tax.

Web By Tanza Loudenback If youve started saving for retirement you probably know that 401 ks are an important tool. Web NerdWallets free 401 k retirement calculator estimates what your 401 k balance will be at retirement by factoring in your contributions employer match your. Find Out How We Can Help You.

Whether you participate in a 401 k 403 b or 457 b. Use this calculator to help compare the. Traditional 401 k calculator helps you compare potential returns from contributions to a traditional 401 k savings account to the potential returns on.

Contributions to traditional 401 k plans are pre-tax which means that your taxes are based on your salary minus your contributions.

The Maximum 401k Contribution Limit Financial Samurai

Roth Vs Traditional 401 K Calculator A Federal Credit Union

Divorce Settlement Archives Certified Divorce Financial Advisor Phoenix Smarter Divorce Solutions

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Simple Roth 401k Vs Traditional 401k Retirement Calculator

Traditional 401k Or Roth 401k Creative Planning

Simple Roth 401k Vs Traditional 401k Retirement Calculator

Roth 401 K S Maximizing Retirement Savings Yellow Cardinal Advisory Group

Free 401k Retirement Calculators Research401k

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Is A 401 K Roth Ira Or Is There Something Better Financial Planning And Stewardship

401 K Vs Roth 401 K How Do You Decide Ellevest

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Is It Better To Do Pre Tax Or Roth 401k Retirewire

Stocks Part Viii The 401k 403b Tsp Ira Roth Buckets Jlcollinsnh

High Earners To Roth 401 K Or Not Greenleaf Trust

8 Retirement Savings Plan Templates In Pdf Doc